How to Fight Excessive Property Taxes During COVID-19

Partner Kieran Jennings and fellow APTC member Greg Hart of Popp Hutcheson co-authored "How to Fight Excessive Property...

Read MoreSteve Nowak discusses multi-family trends in Northeast Ohio

Steve Nowak hosted a panel discussion for REjournals 2020 Cleveland CRE Summit. Steve discussed the Cleveland...

Read MoreIntangibles Are Exempt from Property Tax

Published in GlobeSt.com, August 26, 2020, Cecilia J. Hyun discusses recent lawsuits that remind taxpayaers and...

Read MoreWhy You Should Reevaluate Your Property Taxes in Light of the Coronavirus Pandemic

Partner Sharon DiPaolo and Brendan Kelly co-authored "Why You Should Reevaluate Your Property Taxes in Light of the...

Read MoreHow Your Real Estate Is Valued for Real Estate Tax Purposes

Cecilia J. Hyun published an article in the Ohio Bar Association's Law You Can Use series in March ahead of the Ohio...

Read MoreHigh Property Tax Values in Ohio: The Buckeye State's questionable methods deliver alarmingly high values

Published in Heartland Real Estate Business, April 2020, Steve Nowak analyzes a recent Ohio appeals court case where an...

Read More

Managing Partner Kieran Jennings testifies before Ohio House

Kieran Jennings testified on May 12th before the Ohio House Ways and Means Committee. Kieran advocated for a proposed...

Read More

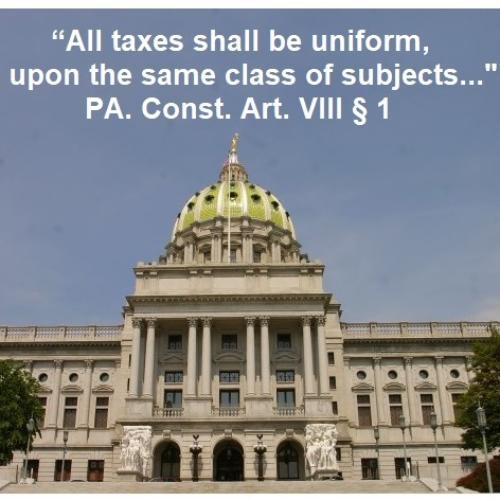

Stage Set for Pennsylvania Supreme Court to Step in to Correct Standard for Uniform Assessment

Partner Sharon DiPaolo authored "Stage Set for Pennsylvania Supreme Court to Step in to Correct Standard for Uniform...

Read MoreOhio Supreme Court decides case involving LLC transfer

In Palmer House Borrower, LLC,[1] the Ohio Supreme Court held a transfer of the interests in an LLC can be presumed to...

Read More

HB 449 to apply real estate transfer tax to entity transfers

Legislation to remove exemption from real estate transfer tax for transfers of controlling interest in a pass-through...

Read More

Kieran Jennings, CRE discusses real property tax assessments in Cook County, Illinois

Bisnow hosted an exciting and informative event Wednesday, January 15th in Chicago. Kieran Jennings, CRE, Managing...

Read More

Why Assessor Estimates Create Ambiguity

Kieran Jennings of Siegel Jennings Co. explains how taxpayers and assessors ensure a fair system, with tremendous...

Read MoreBasics of Pennsylvania eminent domain litigation from the perspective of a former PennDOT lawyer

Senior Associate Ryan Kammerer’s article “Basics of Pennsylvania eminent domain litigation from the perspective of a...

Read MoreChanging Markets, Changing Tax Codes, Changing Property Taxes?

Partners Kieran Jennings and Cecilia J. Hyun coauthored “Changing Markets, Changing Tax Codes, Changing Property Taxes...

Read MoreHow Cook County Takes the Benefit Out of Taxpayer Incentives

Molly Phelan, Partner in the Chicago office, authored “How Cook County Takes the Benefit Out of Taxpayer Incentives” in...

Read MoreThree things TENANTS Need to Know To Protect Against Huge Real Estate Tax Increases When Their Building Is Sold

Partner Sharon DiPaolo was quoted in “Three things TENANTS Need to Know To Protect Against Huge Real Estate Tax...

Read MoreOhio’s Misguided Tax Fix: A proposed law to close ‘LLC loophole’ form real estate transfer taxes is a solution in search of a problem

Partner Cecilia J. Hyun’s article “Ohio’s Misguided Tax Fix: A proposed law to close ‘LLC loophole’ form real estate...

Read MoreBeware the Pitfalls of Condemnation Proceedings

Ryan J. Kammerer’s article “Beware the Pitfalls of Condemnation Proceedings” was published in the May 2018 issue of...

Read MoreIntangible Assets and Your Property Tax Assessment

Partner Cecilia J. Hyun’s article “Intangible Assets and Your Property Tax Assessment” published in Properties magazine...

Read MoreOnerous Property Tax Requirements Proposed

Molly Phelan, Partner in the Chicago office, authored “Onerous Property Tax Requirements Proposed” published in ...

Read More