Time for Your Annual Property Tax Wellness Check

Cecilia Hyun’s article explaining what to look for when reviewing your real estate tax assessments appeared in...

Read MoreAPTC: Ohio School Districts Push for Excessive Property Taxes

Steve Nowak authored "APTC: Ohio School Districts Push for Excessive Property Taxes" published in the December 2021...

Read MoreSelf-Storage Property Taxes: How Assessments are Made and Ways to Potentially Lower Your Bill

In the August, 2021 issue of Inside Self-Storage, Partner Kieran Jennings provides an overview of tax assessments on...

Read MoreCOVID-19 Demands New Property Tax Strategies

In the February, 2021 issue of France Media Inc.'s Heartland Real Estate Business, Partner Jason Lindholm discusses how...

Read MoreHow to Fight Excessive Property Taxes Caused by COVID-19

Partner Kieran Jennings authored "How to Fight Excessive Property Taxes Caused by COVID-19" published in the December...

Read MoreBrendan Kelly discusses opportunities and pitfalls for real estate investors in the Pittsburgh Property Tax Code with knowledgeable, local experts

Read the article here: https://rebusinessonline.com/pitfalls-opportunities-aboun-within-pittsbu...

Read MoreHow to Fight Excessive Property Taxes During COVID-19

Partner Kieran Jennings and fellow APTC member Greg Hart of Popp Hutcheson co-authored "How to Fight Excessive Property...

Read MoreIntangibles Are Exempt from Property Tax

Published in GlobeSt.com, August 26, 2020, Cecilia J. Hyun discusses recent lawsuits that remind taxpayaers and...

Read MoreWhy You Should Reevaluate Your Property Taxes in Light of the Coronavirus Pandemic

Partner Sharon DiPaolo and Brendan Kelly co-authored "Why You Should Reevaluate Your Property Taxes in Light of the...

Read MoreHow Your Real Estate Is Valued for Real Estate Tax Purposes

Cecilia J. Hyun published an article in the Ohio Bar Association's Law You Can Use series in March ahead of the Ohio...

Read MoreHigh Property Tax Values in Ohio: The Buckeye State's questionable methods deliver alarmingly high values

Published in Heartland Real Estate Business, April 2020, Steve Nowak analyzes a recent Ohio appeals court case where an...

Read More

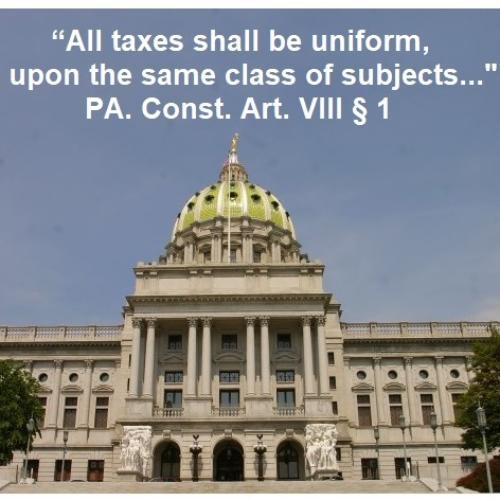

Stage Set for Pennsylvania Supreme Court to Step in to Correct Standard for Uniform Assessment

Partner Sharon DiPaolo authored "Stage Set for Pennsylvania Supreme Court to Step in to Correct Standard for Uniform...

Read More

Why Assessor Estimates Create Ambiguity

Kieran Jennings of Siegel Jennings Co. explains how taxpayers and assessors ensure a fair system, with tremendous...

Read MoreBasics of Pennsylvania eminent domain litigation from the perspective of a former PennDOT lawyer

Senior Associate Ryan Kammerer’s article “Basics of Pennsylvania eminent domain litigation from the perspective of a...

Read MoreChanging Markets, Changing Tax Codes, Changing Property Taxes?

Partners Kieran Jennings and Cecilia J. Hyun coauthored “Changing Markets, Changing Tax Codes, Changing Property Taxes...

Read MoreHow Cook County Takes the Benefit Out of Taxpayer Incentives

Molly Phelan, Partner in the Chicago office, authored “How Cook County Takes the Benefit Out of Taxpayer Incentives” in...

Read MoreThree things TENANTS Need to Know To Protect Against Huge Real Estate Tax Increases When Their Building Is Sold

Partner Sharon DiPaolo was quoted in “Three things TENANTS Need to Know To Protect Against Huge Real Estate Tax...

Read MoreOhio’s Misguided Tax Fix: A proposed law to close ‘LLC loophole’ form real estate transfer taxes is a solution in search of a problem

Partner Cecilia J. Hyun’s article “Ohio’s Misguided Tax Fix: A proposed law to close ‘LLC loophole’ form real estate...

Read MoreBeware the Pitfalls of Condemnation Proceedings

Ryan J. Kammerer’s article “Beware the Pitfalls of Condemnation Proceedings” was published in the May 2018 issue of...

Read MoreIntangible Assets and Your Property Tax Assessment

Partner Cecilia J. Hyun’s article “Intangible Assets and Your Property Tax Assessment” published in Properties magazine...

Read More